A couple of days ago JP Morgan executive Jamie Dimon called bitcoin a “fraud” stated he would fire employee who trade bitcoins as in fact they must be “stupid.” In the meantime it seems that JP Morgan has been caught purchasing a good amount of XBT shares, also known as “exchange traded notes”. These notes track the price of Bitcoin.

[su_quote]”It’s worse than tulip bulbs. It won’t end well. Someone is going to get killed,” Dimon said.[/su_quote]

The JP Morgan Chairman and CEO also joked about bitcoin and told in the media that even his daughter bought some bitcoin, following a trend that made 300% in 2017.

The Bitcoin price from dropped from $4190 by 2% straight after the news and to a low of $2,975.01 (-29%) in about 3 days after. After the lows, prices recovered in no time because of big order and ended up to $3,740 which means +25%.

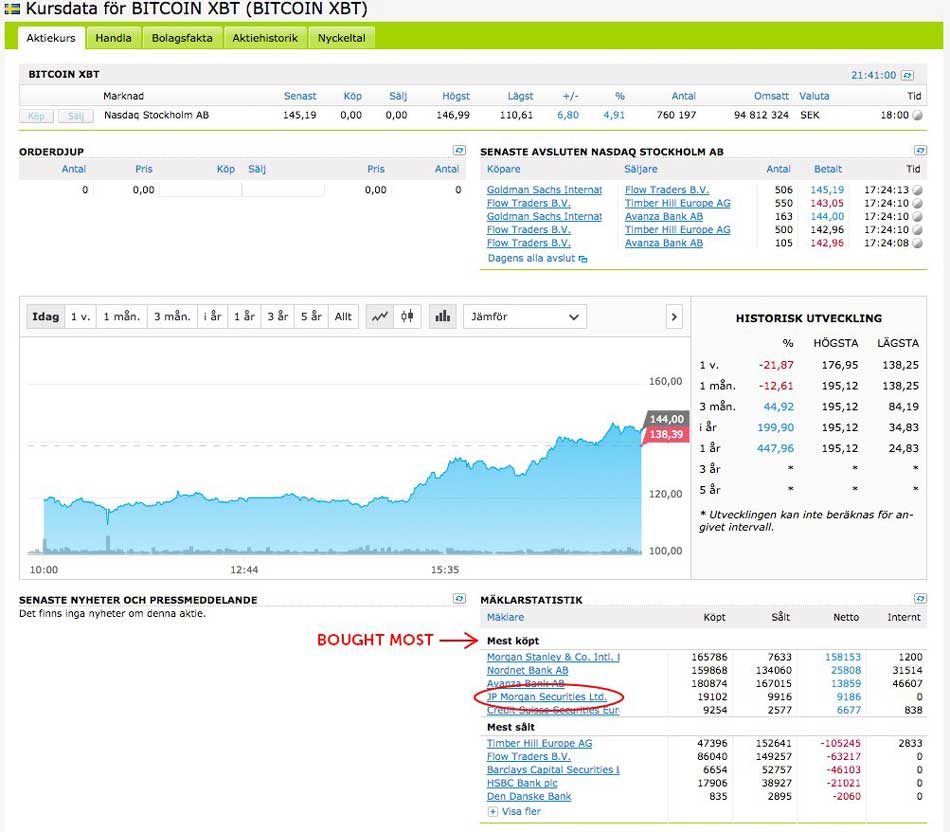

From that point on, the funny side of the story starts and as many people also stated on the internet by questioning if we are talking of just some negative executive statements or even market manipulation via media channels as Nordnet show in their public trading logs, the two financial key players JP Morgan Securities Ltd., and Morgan Stanley bought XBT note shares for about 3 million euros.

So after the recent regulatory case in China, and the JP Morgan’s senior executive Jamie Dimon talking in a pretty negative way about bitcoin, did his company really buy the dip on September 15? Seriously? In fact, out of all the companies on the list, it seems like Goldman Sachs and Barclays, JP Morgan purchased the most XBT notes.

Also worth to mention: Zerohedge reported that JP Morgan not only purchased bitcoin products, but is also heavily involved with the “blockchain business” as it has applied for a so called “bitcoin alternative” patent with the U.S. over 175 times in 2013.