Digital Asset Management – How to store Cryptocurrencies secured and protected

Table of Contents

With various cryptocurrencies like Bitcoin and Ethereum taking the world by storm, crypto security has grown to become a crucial aspect to deal with. In this article, I am going to provide you tips to keep your digital assets / cryptocurrencies safe with the help of so called Wallets (cold storage and hot storage).

If you’re reading this guide, it’s likely that you have invested in this market to trade or keep a particular cryptocurrency amount on hold for future use or trade. I wrote this guide to provide the readers with some insights on how to store cryptocurrencies / digital assets and explain how they can keep their cryptocurrencies in a safe storage. But before anything else, the most important lesson you can learn from this guide is this:

“You are the one in charge of your cryptocurrencies. Thus, their security will be your main concern.”

What is A Cryptocurrency Wallet?

A cryptocurrency wallet is a virtual storage where you can send, receive, and store your cryptocurrencies and use it as a personal digital asset management tool. However, as opposed to a traditional wallet, it doesn’t actually store your funds. Instead, it acts as a safe where you keep your public keys and private keys and allowing you to perform transactions.

A cryptocurrency wallet is a virtual storage where you can send, receive, and store your cryptocurrencies and use it as a personal digital asset management tool. However, as opposed to a traditional wallet, it doesn’t actually store your funds. Instead, it acts as a safe where you keep your public keys and private keys and allowing you to perform transactions.

If you’re wondering what these keys are, let’s take an example out of a real-world situation. Imagine a vending machine. In a vending machine, you can put your money inside. However, there are no means of taking out that money since you don’t have a key. The only one who can access the money inside is the one who owns the machine since he has the key.

Basically, the machine is the public address anyone can use to send you money. You are the owner of the machine, and the only way you can open the machine is by using a key – that is your private key. With your private key, you can withdraw money whenever you like. To put it simply, the public key is where anyone can send you money.

On the other hand, the private key allows you to access your money and send it to anyone else. Your private key is virtually your password – only you should know it, or else anyone can access your money and send it to other addresses.

You have to make sure not to lose your private key. In the event you do, you’re basically FUC**D!!! Fortunately, there are several techniques you can use to keep your private keys safe and secured. That is what we’re going to talk about later in this article. For now, let’s talk about the two techniques you can use for storing your currencies: cold and hot storage.

Digital Asset Management and The Difference between Cold and Hot Storage

To understand the difference between hot and cold storage, let’s use another example from a real world situation. Cold storage is pretty much like your savings bank account. Meanwhile, hot storage is the wallet you carry in your bag or pocket. In order to use your money regularly, you go for the hot storage. However, if you want to keep your money long term, you should go for the cold storage.

Hot Storage

To put it simply, hot storage means storing your funds in an internet ready device. The connection itself is what makes the device “hot”. Various devices such as desktop clients, exchange wallets, mobile wallets, and just about any wallet on an internet-ready device are considered hot wallet. With a hot wallet, you can easily access your funds whenever you want. A hot wallet works just like a real world wallet. It allows you to bring a certain amount of money for convenience and easy access.

While it is very convenient to make transactions with a hot wallet, it comes with a major downside. Basically, a hot wallet can be hacked easily. The latest attacks, particularly on major exchanges, should serve as a warning for newcomers.

Even if you plan to store only a few amount on your hot wallet, you have to follow steps regarding the restoration of your wallet to make sure you don’t lose your funds accidentally. You can easily restore your wallet with the help of your private key and seed words.

Hot Wallet Pros:

- You can easily access your funds.

- There are plenty of options for various devices.

- Easy-to-use interface for easy transactions.

And The Cons:

- Can be easily hacked by hackers and infiltrated.

- Once your device is damaged, your wallet is destroyed as well. If you don’t have a backup of your private keys and seed phrase, it would mean losing your cryptocurrencies.

- You could easily lose your backup details.

Now let’s take a look at the different types of hot storage wallets you can use:

Online Wallets (Cloud Wallet)

Online wallets are considered the easiest to use due to a few good reasons. First, creating an online wallet is very easy since you can create an account on just about any exchange service. Second, you can easily access your wallet no matter where you are as long as your device can connect to the internet. The main problem with online wallets is that your private key is stored on a different server. It means you’re almost giving your key to hackers. When you use an online wallet, do NOT store a lot of money. Just store enough amount you need for quick transactions.

Mobile/Desktop Wallets

Another popular choice for a hot wallet is mobile and desktop wallets. Compared to online wallets, they are a more secure option. A desktop wallet is installed on a PC or laptop and can only be accessed on the device where it’s installed. However, though it is definitely much secure, it’s not really convenient since you can only access your money on the device where the wallet is. Some examples of desktop wallets are Armory and MultiBit.

Mobile wallet, on the other hand, is a lot more convenient since you only need to install an app on your phone. Some of the most popular wallets out there are MyCelium and CoPay. The downside with mobile/desktop wallets is their vulnerability to virus attacks. Hackers can easily infiltrate your system with Trojans and search for your information. Moreover, you can lose your currencies in the event your device is damaged.

Multi-Signature Wallets

To easily understand how multi-signature wallets work, let us think of a safe that requires several keys to access. Basically, multi-signature wallets are advantageous because they:

- Provide an enhanced security for your funds and reduce incidents of human error.

- Create a more democratic wallet that is accessible by several people.

So, how does a multi-sig wallet reduces instances of human error? A good example is BitGo, a well-known and reputed service provider of multi-sig wallets. They provide 3 private keys: one for the company, one for the user, and the other one as a backup which can be kept by the user or given to a trusted person for restoration purposes.

In order to transact in a BitGo multi-sig wallet, at least 2 of the 3 keys are required. Therefore, even if a hacker manages to hack your private key, it will still be extremely difficult for him to hack the other two. Moreover, even if you end up losing your private key, there is still the backup key.

But how do multi-sig wallets create a more democratic wallet? Imagine that you have a team of 5 people and will require approval from at least 3 members to perform a transaction. With a software such as Electrum, you can just set up a custom multi-signature wallet with 5 keys. Through this, you can create democratic transactions within your team.

However, keep in mind that a multi-signature wallet still falls under the hot wallet category; hence, you need to make sure you use it economically. The Bitfinex hack, which occurred even with a multi signature security. Moreover, the company that provided you the wallet service is in possession of one of the keys. It could mean that they can access your funds whenever they wanted to.

Hot Storage and its Risks

Hot wallet, regardless of its type, has its own associated security risk. The ones with the least security are those that are hosted on exchange sites. Even though it sounds like a good idea to leave your currency where you bought it since you can simply convert them to dollars in the event of a crash, it actually doesn’t work that way.

To be honest, leaving your digital assets / cryptocurrencies in the hands of an exchange service is entrusting your money to an mostly unlicensed organization. They have your private keys, plus they deal with attacks on a daily basis. In fact, they’ve even experienced a lot of threats in the past.

Exchange services are very appealing to cybercriminals since they have a lot of information. If you do day trading, you should remember that risk is naturally involved. Moreover, if you plan to store currency long term, you’re better off avoiding it.

Digital asset management is with no doubt increasing its importance. The Bitfinex incident is one of the known examples of the risks associated with hot storage. The incident happened in early August 2016 when Bitfinex’s security has been infiltrated. It has led to more than $72 million worth of Bitcoin stolen by a hacker.

It had such a devastating impact that Bitcoin’s value went down by 20% in just one day. So, how can you avoid such thing from happening? How to store cryptocurrencies safe and protected? One answer is cold storage. But what is cold storage?

Cold Storage

A cold storage is when your currency is stored in an offline device. If you want to make sure your investment is kept in the most secure storage, then you should go for cold wallets. They are considered the best type of storage especially for holders who want to keep their money in a secure environment for several months or even years.

Although a cold storage has its share of risks, you can greatly minimize those risks by following instructions and taking precautionary measures. With cryptocurrency getting more and more popularity over these past few years, it has caught the attention of attackers. To alleviate the issue, cold storage has been created to provide a more secure method of storing money.

CoinBase, a reputed Bitcoin wallet and exchange service based in San Francisco, uses hardware and paper wallets for securing 97% of its funds. What are hardware and paper wallets? We’ll talk about them later. Before that, let us first find out the pros and cons that cold storage has.

Pros:

- It’s a good place to keep huge amounts of money for long term storage.

- Due to its offline nature, it’s protected against hackers and cybercriminals.

Cons:

- It’s not a convenient method if you want to use your money for quick transactions.

- The setup process might seem complicated for beginners.

- It’s still prone to external damage.

Now that we’ve known about the pros and cons associated with cold storage, let us discuss a few cold storage wallets available out there.

Hardware Wallets

Hardware wallets refer to physical devices that are capable of storing cryptocurrencies. They are available in several forms with the most popular among them, which is the USB stick by the Nano Ledger series.

Even though a lot of people use them, hardware wallets are not immune to exploitations. First of all, you’re leaving your funds in the hands of a company who created your wallet, trusting that they won’t access your account through the private keys. This is applicable to those who acquired the wallet directly from the company, although it could also apply to those who bought a pre owned wallet. Regardless of the situation, you should never ever use a second hand hardware wallet.

Hardware wallets could possibly get lost or damaged, it’s still possible to restore them. This is possible by creating a backup just like an online hot wallet. You should store your backup details in a secure place where only you know about. Since your details will help you open your wallet, make sure you choose who you share them with carefully.

Moreover, you should make sure to transfer your funds to an entirely new wallet in the event something happens between you and the other person who knows about your private keys.

Some of the known hardware wallets you can use include Ledger Nano S, Trezor, and Keepkey.

Paper Wallets

It can’t be denied that a paper wallet is the safest method for storing your cryptocurrencies. To help you set up your wallet for free, I have provided several pointers below for you to follow. With a paper wallet, it will be impossible for anyone to know your private keys, especially if you follow a few precautions. However, you should always make sure to keep your own record. Of course, like any other wallets, you’ll also lose the funds in your paper wallet if you lose your private keys.

An Overview of Paper Wallets

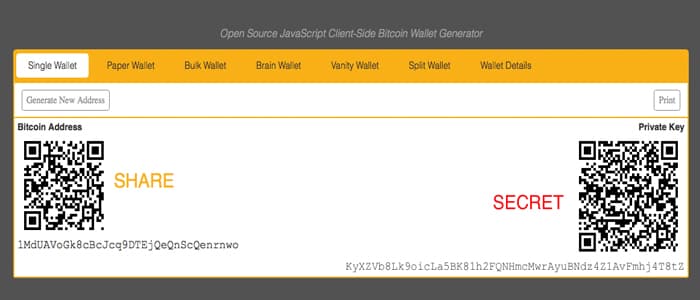

A paper wallet is a cold storage method that is created offline. Both your public and private keys are printed on a piece of paper and are then stored for safekeeping. The keys come in QR codes you scan whenever you make a transaction.

What makes a paper wallet safe is the fact that you have complete control of your wallet. There’s no need to bring a piece of hardware with you. Moreover, you don’t even have to deal with virus attacks or cyber attacks from hackers. What you need is just a piece of paper.

Is a Paper Wallet Right for You?

The answer ultimately depends on where or how you plan to use your cryptocurrencies. If you’re planning to spend your funds on a regular basis, a paper wallet might not be that ideal at all. However, if you plan to keep your money for a long period of time, then a paper wallet is no doubt the most reliable and secure method you can opt for.

How to Set Up Your Own Paper Wallet

To set up a paper wallet, you will need a program that generates keys randomly. Keys generated are unique and won’t be similar to each other. Moreover, the program used for generating keys is open source. If you are familiar with coding, you can have a look at the program’s backend to confirm its randomicity. Also, the keys are generated offline. This means your keys won’t be published online by any means, and deleting the generator will wipe off any trace.

It might sound complicated, but it’s not. You don’t need any advanced or even basic coding knowledge. You simply need your computer, internet, and something you can use to keep a record of your keys. To create a paper wallet, simply follow the following steps:

- Make sure your computer doesn’t have any malicious software. You might want to purchase a brand new unit, although it’s not really necessary.

- Visit WalletGenerator.net. Afterwards, download the zip file.

- After downloading the file, turn off your internet and open the “index.html” file. This is a really important step to follow since it ensures that your wallet is completely hacker-free.

- Once you’re done, you can now start generating your wallet. To do so, simply hover over the highlighted text or manually type random characters until the counter reaches zero.

- After the counter reaches zero, your wallet is created. Make sure to save several copies of the keys by printing them. Also while printing, make sure your printer is disconnected from the internet.

- Lastly, delete your saved web page and clear your history. Make sure to keep the private keys in a safe and secure place. You may now reconnect to the internet afterward.

How to Set Up Paper Wallet for Ethereum

Creating a paper wallet for Ethereum is currently not available on WalletGenerator. Therefore, if you want to set up a paper wallet for Ethereum, you will need to follow a different procedure. However, like setting up a paper wallet for other cryptocurrencies, the entire process is very easy. Simply follow these steps:

- Visit MyEtherWallet.com.

- On the Help section, look for the “Using MyEtherWallet for cold storage” option.

- Next, open the highlighted link and download the EtherWallet zip file.

- After downloading the zip file, disconnect from the internet. Afterwards, click the “index.html” file.

- Create your password and click the “Generate Wallet button”. Make sure you use a strong password to further enhance your security.

- Now you need to download your keystore/UTC file and store it on a USB. Also, don’t forget to create backups of this file. Once you’re done, click the “I understand. Continue.” button.

- You now have your wallet with your private key. No matter what, do NOT share your private key with anyone.

- Make sure you print your wallet, which displays your public and private key, and creates multiple backups and store them for safekeeping.

Risks Associated with Paper Wallets

Although paper wallets are the safest form of cryptocurrency storage, there are still risks associated with them. Some of these risks are the following:

- Human error – human error is the most common risk associated with paper wallets. As humans, we can sometimes forget where we keep our copies or accidentally tear them.

- Stealing – since it is printed on a piece of paper, it can be stolen by anyone even by just taking a photograph of it;

- Prone to disasters – it’s just paper, meaning it’s susceptible to natural disasters if not stored properly;

- Fragile – paper can easily get damaged over time. It is for this reason why creating backups is of absolute must;

- Coercion – since there will always be people who aren’t afraid to commit crimes, your paper wallet won’t always be secured. If you keep your papers on a safe and a burglar stumbles upon it, he will definitely try to break the safe and steal your backups along with any other valuables. The moral lesson here is simple: never brag your crypto investments to just about anyone. Whether it’s online or offline, it’s not a good idea. It could only make you an easy target for crooks; and

- Printer used – the type of printer you used for creating backups could drastically affect your papers. If you used a non-laser printer, the ink could run if the paper gets wet.

Why Private Keys and Restoration Methods are Important

Just like how I mentioned restoration details earlier, your paper wallet’s private key is the single most important detail you should keep. In the event you lose your private key, you end up losing your money. However, make sure that you only keep them in a place where only you know. As anyone that has the key can access your money, you should make sure they’re kept completely hidden.

A good idea would be to secure your backups in various secure locations. Through this, even if you lost one or two copies due to natural disasters such as flood, hurricane, or tornadoes, you still have several backups available. However, it could also be counterproductive as the more locations you store your keys, the more likely they will get compromised.

Under Lock and Key

There are people who prefer the use of physical locations for storing their private keys. One of the most popular options is a safe. If you choose a safe, make sure you only provide access to the combination or even the location to someone you completely trust. Of course, small safes aren’t really durable and can be broken easily by home invaders.

It’s best to invest in a high quality safe to be sure, unless you want to risk the security of your keys. Regardless, you should only keep access to the safe on your own, or to someone you completely trust like your spouse.

Cloud Storage

In the near future, decentralized cloud-based storage will become an option. Although tests are still conducted to verify its reliability, it could possibly rid of concerns regarding storing private keys on a digital platform. The problem is, cloud-based storage services can be hacked by cybercriminals.

This would mean that keeping your most confidential information isn’t recommended. Fortunately, you can do the encryption yourself and then store it online. Through an encryption, only a few people can possibly view your unencrypted document. Encrypting a private key before uploading them to the internet is a viable option for some individuals.

Metal Engraving

If you want, you can engrave your keys in a metal then keep it in a safe and secure location. However, make sure you choose a good quality metal as a poor quality material will deteriorate quickly.

Memory

Committing your private keys into memory is possibly the most secure method for storage; however, it really isn’t ideal. A private key is composed of 64 unique characters, and most people have a hard time remembering even 10 of them. Although this seems like a viable method to some, it’s not really reliable.

When storing your private keys, make sure you consider the following:

- Most practical methods of keeping private keys tend to end up in keys being lost. Factors like theft, water damage, and fires are just some of the few. If you can engrave your private keys to metals by yourself, then keep it in a high quality safe, then it is ideal.

- Make sure to keep the access to the private keys on yourself.

- Keeping your backups in several safe locations is actually a good idea. However, while you’re at it, make sure those locations won’t compromise security.

- Each storage has its own risks – make sure to keep them to a bare minimum.

How to Restore a Cold Storage Wallet

If you need to restore your cryptocurrency from a cold storage wallet, you have to import your private key into a reliable online wallet. It should be an online wallet that provides support for importing private keys. The restoration process is actually simple and straightforward for most wallets. For example, if you want to restore your cryptocurrency using the Bitcoin Unlimited Wallet, these are the steps you should follow:

- Open the client then click “Help”.

- Click the Debug Window then the Console tab.

- Replace <private key> in the field “importprivkey<private key>” with your private key. Don’t forget to remove the quotation marks.

- Press Enter.

If you follow the instructions properly, it will start importing all data from your paper wallet to a client in your desktop. However, keep in mind that by doing this, you’re now vulnerable to the risks involved with hot wallets.

Make sure that you only store a small amount of cryptocurrency which you’re going to use for daily transactions. Avoid storing huge amounts. If you only use a fraction of your funds for a transaction and want to store the remaining balance in a cold storage, it’s recommended to create a new paper wallet from scratch.

The process of creating a cold wallet is an easy means of reducing risks that come with other crypto security methods. Although no storage method is completely free from threats and security breaches, storing your currencies offline will significantly reduce the chances of your funds being compromised.

Digital Asset Management Conclusion

When it comes to a solid digital asset management there are professional providers and services out there which are still for smaller investors not an option for now. Still, you have to keep an eye on real-world risks like theft, loss, or damage to your keys.

Always keep your private keys protected. Also, it is recommended to set up a new cold storage as soon as possible once you believe their security has been breached.

The best possible solution you could ever resort to is diversification. It would mean keeping a major portion of your currencies in paper wallets and creating multiple backups for your keys to make sure you can restore them easily. Use hardware wallets for storing some of them, and if the need be, keep a small portion on a hot wallet if you plan to perform quick transactions. That said, make sure to store the majority of your currencies in a cold storage.

Always keep in mind that you are the one responsible for the safekeeping of your investments. Do not slack on security, as it is the most important thing as far as cryptocurrency is concerned.

There’s already been a lot of people who have lost their keys and even their cryptocurrencies due to their own faults and some security breaches. Take your personal digital asset management serious! Don’t be one of those people. As much as possible, keep the risks to a minimum in order to significantly reduce your chances of becoming one of them.