Facebook Libra Coin or Cryptocurrency or just a heavily promoted payment network? Facebook has finally shared some information involved with its own version of what they call a cryptocurrency, with the name Libra. Let us assume Libra is a cryptocurrency, so as with most cryptocurrencies, this one enables you to buy products online and send cash with almost zero fees to your friends and family.

Not even started there seems to be trouble coming down the road read more. However, just recently Facebook revealed Libra’s white paper which includes all the details about their coin. The paper explains how Libra works and how its developers are conducting various tests to further get rid of any flaws in the system before it gets launched in the first half of 2020.

The Libra coin will let you anonymously acquire and withdraw your funds at various exchange points mostly of course online. Meanwhile, you can spend it on third-party apps or via Facebook’s very own Calibra wallet which will be integrated into various applications like the Facebook Messenger and Whatsapp.

Libra won’t be totally managed by Facebook, however. Its operation will fall into the hands of the founding members of the Libra Association who have invested 10 million dollars each for the project’s management.

Together with Uber, Visa, and Andreessen Horowitz, the association will be able to market the Libra Blockchain alongside the developer platform with its own programming language called Move. At the same time, they will also include some businesses that will take Facebooks Libra as payment and provide customers with rewards and discounts.

Meanwhile, Facebook is going to launch a subsidiary also known as Calibra to manage its cryptocurrency trades and secure the privacy of the users by preventing your Facebook data from merging with your payments done in Libra in the future. This ensures that it can’t be used to target ads. (At least that’s what they say and what I personally would take with a grain of salt).

Additionally, your personal information will remain confidential. Despite that, Calibra, Facebook, and the Libra Association’s founding members will earn interest for every money that users cash in as a way to keep the crypto’s value stable.

Facebook’s move of creating their own version of a digital currency truly has additional decentralization and privacy than most people expected. Rather than attempting to control the future of Libra or trying to benefit plenty of money from it instantly, Facebook is alternatively enjoying the game by generating payments by using its online presence.

David Marcus, Vice President of Blockchain at Facebook, discussed the company’s objective and also the tie with its core revenue supply throughout a meeting at the historic Mint building located in San Francisco. He also stated that if additional dealings would happen, then a lot of small businesses can market their products inside as well as outside of the platform. Therefore, business owners will gain interest to purchase additional ads on the platform, making it beneficial to their advertisement business.

A Coin to Look Out For?

Table of Contents

Beside the question if Facebook is the right company to do such a big thing, let’s also be fair and honest: Facebook did make the right decision, without a doubt: today’s cash does not work for everybody. People who are living easily in developed countries likely don’t see the hardships that happen to transient laborers or the unbanked people abroad. They are preyed by eager banks and remittance services with high fees and are left to choose conventional financial services which are more and more outdated. With that, the poor just gets more and more unfortunate.

That would accomplish more to achieve Facebook’s main goal of making the world feel a bit smaller than all the combined Facebook Likes. Is that good or bad? You decide! As I stated already, it might be a great product and service but with the wrong company!

In the event that Facebook achieves their goal and individuals put in money for Libra, Facebook and other exclusive members from the association can possibly be given huge interest. What’s more, if all of a sudden it turns out to be excessively snappy to purchase things through Facebook using Libra, organizations will support their advertisement there and jump on it.

If Libra’s system gets compromised or demonstrates unreliability, it could cost lots of individuals around the globe tons of cash, and this will cause them to think negatively of cryptocurrencies.

Furthermore, by offering a platform that is open, fraudulent developers could fabricate applications that grab not only individuals’ private information but also their well-earned cash.

How Facebook Libra Actually Works?

The social media giant has made a hundred pages of documentation on Calibra and Libra available to the general public, and we’re going to share with you all of those important facts.

With that, you can start to deposit money using local currency, receive your Libra coins, spend them as you would with real-life money, and cash it out whenever you like.

However, there are still plenty of interesting information you might want to know such as the undisclosed technology, the organization that oversees it, the wallets you’ll utilize, and the way your payments will operate.

The Libra Association

Facebook knew that individuals are quite skeptic if they ever plan to steer people away from the cryptocurrency they currently use. Therefore, Facebook appointed the founding members of the association which is a non-profit organization that supervises the progression of the token. They were the ones who will take control of it, only a handful of people will be interested. Thus, they thought of recruiting various organizations so it will be taken more seriously.

Founding members had paid a minimum amount required to take part and become an operator for their validator node at their will. If a member gains one vote in the Libra Association council, they will be entrusted with a share of dividends which is equal to the initial investment they had put in. The interest earned is from the Libra reserve which users paid for by using fiat currency to acquire Libra.

There seem to be twenty-eight future founding members of the Libra Association. Their names and industries are as follows:

- Online market and tech Companies: Farfetch, Spotify AB, Lyft, Calibra, Facebook, Uber, eBay, Booking Holdings, Mercado Pago

- Payments: Stripe, Paypal, Mastercard, Visa, PayU

- Telecom companies: Vodafone Group, Iliad

- Blockchain: Xapo Holdings Limited, Bison Trails, Inc., Anchorage, Coinbase

- Ventures: Ribbit Capital, Breakthrough Initiatives, Union Square Ventures, Thrive Capital, Andreessen Horowitz

- Nonprofit organizations and academic institutions: Kiva, CD Laboratories, Mercy Corps

Facebook is hoping to get to at least one hundred founding members before the launching of Libra in 2020, and the slots are available to every company who will be able to meet their requirements, including rivals like Twitter and Google.

The association is currently based in Switzerland, specifically in Geneva, and they are planning to hold a meeting twice a year. Switzerland was favoured due to its unbiased stature as a nation and unwavering support for financial developments including cryptocurrency.

Who Gets the Vote for Facebooks Libra’s Overall Management?

To be able to join and be affiliated, individuals must have an ample rack of space for their server, an internet connection that does not go below 100Mbps, and an employee who specializes in website engineering and security. Organizations must potentially be perceived as a part of the top 100 industry pioneers by a company like the S&P or Interbrand Global.

Crypto-centered financial investors must have assets that are worth one billion while Blockchain organizations are required to have a year of operations, business-grade security, protection, and more than one hundred million in resources. Furthermore, just up to thirty-three percent of establishing individuals can be crypto-related organizations, though there are some companies that can be exempted and invited individually.

Facebook acknowledges research associations like colleges and philanthropies that have met three of the four characteristics: engaging in monetary incorporation for over five years, global reach to a bunch of clients, part of the top 100 that is assigned by a Charity Navigator, as well as fifty million in spending plan.

The association will be in charge of enlisting more members who will undergo the process to operate for the blockchain as a validator node, raising support to kick off the ecosystem, plan motivating projects to compensate investors, and distribute social effect stipends. A committee with an agent from every institution will help pick the organization’s overseeing chief, and he/she is assigned to appoint an official group and choose a leading body of five to nineteen top delegates.

Every member can get up just one vote of the total number of votes (whichever is bigger) in the council. This gives a level of subsidiarity that secures against Facebook or some other player that is using Libra to take advantage and profit from it. By staying away from having Libra’s sole proprietorship and territory, Facebook could dodge further criticism from watchdogs who currently research for issues such as privacy maltreatment and hostile to aggressive conduct.

While trying to seize evaluation from lawmakers, the Libra Association stated that they welcome open request and responsibility. They added that they are focused on an exchange with policymakers and regulators and share policymakers’ enthusiasm for the national currency’s stability.

The Advantages and Downsides of Developing a “Paypal Alternative”

Facebook saw cryptocurrency as both an opportunity and a cause of alarm. They commit themselves to breaking the conventional way of how products are purchased and marketed by removing transaction fees that are normally present when credit cards are involved.

This is closely similar to Facebook’s advertisement business which controls what is purchased and sold.

If a rival that is similar to Google and other startup companies introduce a well-liked coin and observe the transactions, they would learn what folks obtain and will chime in on the money spent on Facebook’s marketing. For now, people who are unbanked may also opt to choose a substitute financial service as their profile lender online. That’s another aspiration that Facebook desires to obtain.

However, cryptocurrencies such as Ethereum and Bitcoin were not properly designed to be a way of payment exchange as they’re subject to large and volatile changes, making it difficult for sellers to use as their mode of payment.

Also, cryptocurrencies miss out on an opportunity to spread the benefits of the digital currency to the masses. However, with Facebook’s relationship with millions of advertisers and small businesses, it can absolutely take on the challenge to beat its competitors.

At present, Facebook desires to turn Libra a successor to PayPal. Hopes are high that Libra will be less complicated, globally available as a payment method, more economical with lesser fees, available to the unbanked, and more adaptable due to the developers’ effort to make the system as good as possible.

Facebook included in its Libra documentation that its success can mean that someone that is living or working in other countries has a quick way to send cash back home to their families, and a university student can pay his rent as quickly as if he’s buying a cup of coffee. This will be an enormous improvement these days as tons of remittance services tend to charge an average of 7% transaction fees which equate to billions of dollars taken from customers every year.

Facebook is known to design products that are over-engineered but disregarded. As of now, they will need the assistance of other companies if they want to substitute what’s already existing and known by people.

Meanwhile, Libra is capable of doing microtransactions that are priced for a very minimal amount only. Otherwise, it can also be globally unnoticed by customers who perceive it to be inconvenient to use for an insufficient reward or rather uneducated with the modern financial setting.

How Stable is Libra?

A three parallel and wavy Unicode character ≋ is what represents Libra as a unit of the digital currency. Libra’s worth is intended to remain to a steady and secured extent, thus it’s a decent mode of trade as dealers can be sure they won’t be compensated a Libra today that will be of lesser amount tomorrow.

The value of Libra is entwined to short-term securities investment and bank deposits for a large number of stable worldwide monetary forms which includes the pound, euro, dollar, yen, and Swiss franc. They keep up this crate of benefits which can alter the equivalence of its composition if it is deemed important by the Libra Association to counterbalance price volatility in any single foreign currency with the goal that the estimation of Libra will remain stable.

Libra’s name was originated from a Roman word that is used when referring to a unit of weight. It is attempting to summon a feeling of being financially free by using the French term called “Lib” which meant being free.

Libra’s starting value is still being worked out by the Libra Association, yet it is intended to be someplace near the estimation of a pound, dollar, or euro to make it a lot easier to envision its worth. For example, it might cost 3 to 4 Libra for one gallon of milk in the U.S., almost the same but not actually equivalent to the current rate in U.S. currency.

The aim of the creators is that you will trade out some cash and keep Libra in an equal amount that you can spend at accepting stores and services online. You will have the option to exchange your local currency for a Libra then the other way around through certain wallet application like Facebook’s Calibra as well as third-party wallet applications and neighborhood affiliates such as groceries and convenience stores.

Information about Libra’s Reserve

Each time someone deposits money in his local currency, the cash goes into the reserve, and an identical estimation of Libra will be printed and given to that individual. In any chance that somebody gets the money from the Libra Association, the Libra they decide to give back is crushed, and they will get the identical value in their local currency back.

This only means that there is constantly 100% of the estimation of the Libra available for use, and Libra Reserve will collateralize it using true resources. It doesn’t run fragmentarily. What’s more, unlike the stable coins which are attached to a single currency like the US dollar, Libra keeps up its very own worth — however that should only cash out to an amount that is similar to a certain currency after some time.

Whenever members of the Libra Association join and pay a minimum of 10 million dollars, they will get Libra’s Investment Tokens. Their share of tokens converts into the extent of the profit they get out of interest on reserve’s resources. After the association uses the interest to pay for working costs, interests in the ecosystem, engineering researches, and stipends to philanthropies and different associations, profits will be paid out.

This interest that they will get is one of the things that attracts members to become interested to be part of the Libra Association. If by any chance, Libra becomes famous and widely accepted, with numerous individuals acquiring a huge amount of the currency, the reserve will become gigantic and interests massively grow.

Libra is Built for Reliable Speed

Each payment that Libra gets is written down in the Libra Blockchain forever — a cryptographically validated database that goes about as an open online record intended to deal with a thousand exchanges for each second.

That makes it a lot quicker than Bitcoin’s seven exchanges each second and fifteen for Ethereum. The Libra Association’s founding members operate and constantly verifies the blockchain where each member contributed ten million dollars or more to get a slot in the digital money’s management and the means to be a validator node operator.

After every submitted transaction, each and every node makes a calculation dependent on the current record of transactions. On account of a tolerance framework, only sixty-six percent of the nodes must come to an agreement that the exchange is real to finally be accomplished and recorded to the blockchain.

The Merkle Trees structure in the code makes it easy to perceive any blockchain changes. With 5KB exchanges, 1,000 confirmations for each second on commodity CPUs and billions of records, the Libra Blockchain ought to have the option to work at 1,000 exchanges for each second in the event that the nodes will utilize at least a 40Mbps connection and 16TB SSDs.

Exchanges within Libra cannot be turned around. In the event that an online assault endangers more than 33% of the nodes which can cause problems in the blockchain, it will briefly stop exchanges, detect how much damage has been caused, and prescribe updates to fix the problem.

Transactions or exchanges are not completely free. They cause a minor portion of a penny to pay for “fuel” that takes care of the expense of handling the exchange of assets like when using Ethereum. This expense will be insignificant to most buyers; however, when they count up, the fuel charges may prevent terrible online fraudsters from making a lot of transactions to power spam and make service assaults.

At present, the Libra Blockchain is considered as “permissioned”. This means that the only people who finished certain requirements are admitted to an exclusive group that will control and manage the blockchain. The issue is this system is progressively helpless against censorship and assaults since it’s not really decentralized.

In any case, during Facebook’s exploration, they could not locate a dependable permissionless framework that could safely scale to the number of exchanges Libra should deal with. Adding more nodes backs things off, and nobody has demonstrated an approach to evade that without trading off security.

That is the reason why the Libra’s Association will probably move to a less strict framework which is dependent on verification that is capable of securing against assaults by dispersing control, empowering rivalry, and entering in a much lower boundary. It needs to have a minimum of 20% of approval in the Libra Association board originating from node administrators depending on their complete Libra possessions rather than their status as an exclusive member.

That arrangement should help pacify blockchain conservatives who won’t be fulfilled until the token gets entirely decentralized.

The “Move Coding Language”

Any developer can make applications that work with the Libra Blockchain by utilizing the Move coding language. The blockchain’s model recently launched its testnet, so it is currently in beta mode for developers until it launches officially in the middle of 2020.

Meanwhile, they are executing the Libra Core which uses the Rust programming language since it’s intended to avert security vulnerabilities, and the Move language isn’t completely prepared at this point.

The Move language was made to provide a simpler way to compose a blockchain code that pursues a creator’s plan without presenting any bugs. It is named Move due to its essential capacity to move Libra coins starting with one record then onto the next and never let those advantages be inadvertently copied.

In the long run, developers who are using Move will almost certainly make smart contracts for automatic cooperations with the Blockchain. At the point where Move is prepared, developers can make modules and exchange contents for Libra utilizing Move IR. The ecosystem of Libra and the Move language will be opened for users to utilize which shows a sizable hazard.

Fraudulent developers could go after crypto beginners, asserting their application works the same as the legitimate and may also state that it is secured in light of the fact that it utilizes Libra.

Be that as it may, if customers get fooled by these con artists, the indignation will doubtlessly rise to Facebook. Despite the fact that it’s attempted to separate itself adequately by means of its subsidiary Libra and the affiliation, numerous individuals will likely think that Libra is Facebook’s digital currency.

The coding language was planned to be made meticulously, hence the launching date will be a year from now to prevent further problems that will remind people of the previous privacy issues of Facebook which made them known as a platform that is unsecured.

It will be quite difficult for people to entrust their private information again if another security breach happens. Even if Facebook is not the sole proprietor of Libra, news all over the internet still makes them wholly responsible if any problem occurs.

Part of Libra’s Incentives is Rewards for Early Investors

An attempt to encourage more dealers and developers is another goal to attain for the Libra Association to make them interested with its digital currency. It is for this reason why they intend to give rewards to operators of validator nodes who can convince individuals to accept and utilize Libra. A number of wallets that force customers through the KYC tax evasion process and anti-fraud or that keep customers actively engaged for more than one year will get incentives.

For every transaction they make, dealers will likewise get a level of the exchange back. Organizations that will get these rewards can keep it or send a few of it to clients with free tokens of Libra or rebates on every purchase. This could make rivalry amongst wallets to know which one will be able to pass on the most perks to its clients. Also, this will allow them to pull in the highest number of customers.

Alex Norström, Chief Business Officer for Spotify, stated that a test for Spotify and Spotify’s clients around the globe has been the absence of payment systems that are accessible – particularly those that are in monetarily underserved markets. For him, getting the chance to join the Libra Association is an opportunity to further increase their chances of achieving Spotify’s addressable market, enabling payments, and removing friction on a large scale.

This smart reward system is ought to hugely help increase the client count of Libra without directing how organizations balance their edges versus development. Facebook additionally has another arrangement to develop its designer biological system. By offering investment firms like Union Square Ventures and Andreessen Horowitz as a part of the interest, they are spurring to finance new businesses building Libra framework.

Utilizing Libra

The main goal is to be able to send money as quick as sending a text message. Users won’t almost certainly make or get genuine transactions not until the official release one year from now; however, you can agree to register for early access when it’s already available.

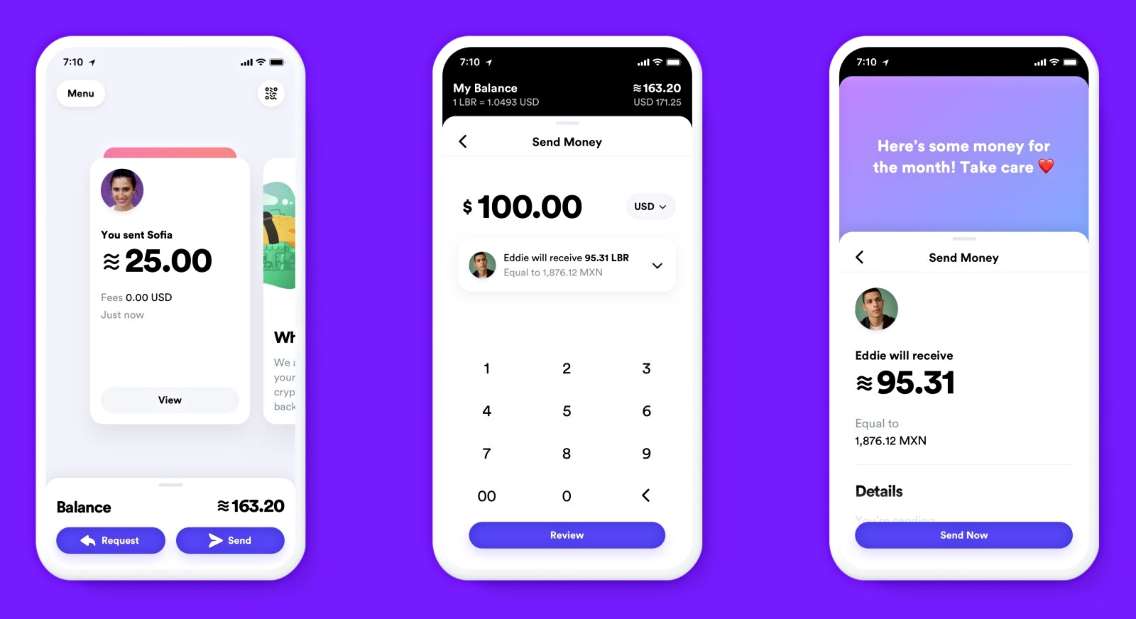

None of the members of the Libra Association is given consent to share information on what they will precisely do on the blockchain. However, we can accept Calibra’s wallet to be an example of the fundamental experience. Facebook shared that Calibra may be released at the same time as the Libra currency on Android and iOS inside Messenger and other independent application.

At the point when clients first sign up, they will be taken through a KYC process to pass the anti-fraud process where they will be required to give an official personal identification card and confirmation data. They will have to assess clients and report immediately to authorities if ever they sense a suspicious activity.

From that point, you will have the option to deposit to Libra, pick a merchant or a friend, set a sum to send to them, and include a short description to finally give them a Libra. You will likewise have the option to demand Libra, and then immediately, Calibra will offer an expedited method for paying dealers by examining your ID or QR code, if necessary. In the end, it needs to offer payments to be made in-store and with system integrations that are offering payments for goods.

E-commerce affiliates of the Libra Association appear to be especially hyped on how the token could remove exchange fees and accelerate the checkout process.

FarFetch’s CEO, Jose Neves, stated that they have the faith that blockchain will profit the extravagance business by enhancing IP security, straightforwardness in the item lifespan (as on account of Libra), and empower worldwide friction less online business.

Let’s also face reality

From my personal point of view there are facts we should not ignore since I read tons of articles even published by famous and known industry entrepreneurs which brought me to the point, they seem to have never read one single line of the Libra Whitepaper!

So let us be clear when it comes to some key facts:

The definition of Libra does not really fulfil the criteria to be handled as a cryptocurrency! It is backed by fiat currencies and transactions are performed by some companies. Cryptocurrencies are never linked to a single party with censorship powers and they assume a level of anonymity of its participants.

It is also not a new and fancy part of fintech technology. It’s a digital payment network with an already identified user base within Facebook rather than a new technology. But let’s be fair, it’s a great idea just maybe the wrong company.

Meanwhile the US Congress asks Facebook to pause the Libra development – read more

What do you guys think? Would you trust Facebook enough to utilize it as a payment or even banking provider? Leave a comment below and have a serious discussion.