Evidence of a Bitcoin Bubble?

Table of Contents

The simple truth about Bitcoin and cryptocurrencies is, that no one has a real clue and all the made predictions you can watch on YouTube are just nonsense and entertainment without any serious background. We experience something that is so unique that we have no experience where we could draw back on, that’s a fact we should not forget about. Cryptocurrencies are a big chance to invest in and also a big chance together with the blockchain to revolutionize many industries.

On the other side we have enough facts in order to do some comparisons:

The impossible math of the Dollar / Euro debt continues and should be taken very serious, also in case people won’t trust the financial system any longer in times of rising crisis, conflicts and the speed-up of information sharing. Central banks might jump in to support the markets but the question is, how long this game will last.

In times of the internet and social media, the information flow is no longer as controlled as it was in the past. Of course channels of any kind still can be manipulated with fake news but if we look at the content out there to get informed, we might notice that times have changed and more and more people get aware and ask questions of what is going on around them.

It’s not a secret that Bitcoin in a long term might provide a more valuable store compared to assets which have a backdoor connection to central banks (Some people might also call it “manipulated by central banks”). The use of Bitcoin will increase as more and more digital interfaces start to get compatible with the cryptocurrency world and not only web shops try to jump on the cryptocurrency train (Remember the google API?).

In terms of security, all Bitcoin transactions are secured on a public ledger which stores and lists all of the confirmed Bitcoin transactions. Compared to centralized ledgers, the decentralized bookkeeping is much more secure in many ways.

But “Experts” claim there is evidence of a Bitcoin Bubble

My opinion: It will correct and go down, yes! It will follow the cycle and maybe it might even turn out as not really practicable but thats pure speculation, nobody really knows and predictions are pure nonsense:

I fully understand the argument which is mostly stated by people who never really understood the Blockchain itself. From an outer perspective without a fundamental understanding of what the Blockchain does, how it works and how cryptocurrencies use this technology, people compare cryptocurrencies to coins they hold in their hands such as euros or Swiss Franks or in other words fiat money! History teaches us what fiat based money systems mean and how they behave -> they are inflationary and most of them simply failed!

The fiat vs. cryptocurrency comparison lacks and is the reason why these people (“So called experts”) get stuck with their arguments and repeat them over and over again!

Look at the Dot.com Bubble

One of the most brought up arguments you can read these days is “The Bitcoin Bubble will burst the same way as the Dot.com Bubble did!”.

What these “experts” seem not want to understand or they simply don’t want the people to understand is, the Dot.com Bubble was about $6.7 trillion in market cap while Bitcoins current market cap is about 100 Billion USD.

The majority of people these days doesn’t even know how to buy Bitcoins. Most of the banks do not offer any products to their clients which is quite reasonable. So how can anyone compare the Dot.com Bubble to the current Bitcoin development? It just doesn’t work!

Some more interesting facts – The supply

Another point worth to mention: Bitcoins supply is limited to 21 million Bitcoins and this number can’t be increased, compared to fiat currencies.

Ben Bernanke himself stated on the 21st November 2002 the following:

“Like gold, U.S. dollars have value only to the extent that they are strictly limited in supply.”

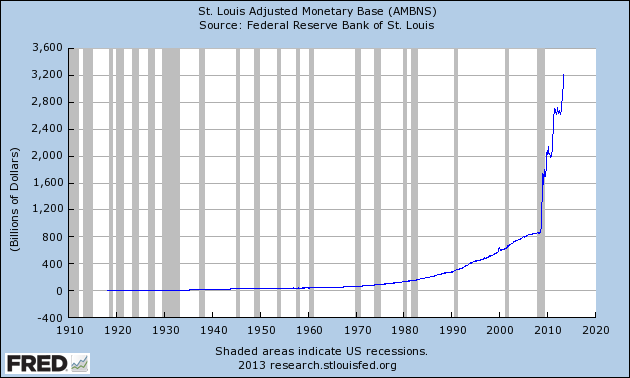

Maybe a good time to mention the current US money supply for those who are not aware of its doubtful status. It is about USD 13.5 Trillion = $13,500,000,000,000 and still growing.

Does that sound or look like a good store of value to you? Build your own opinion and do some research.

In the meantime while the money supply grows, the US debt does it the same way and has a record high of USD 20 Trillion.

Compared to that, do your own research and build your own opinion if Bitcoin is in a bubble or not. As mentioned, the truth is that nobody really knows where the crypto journey will go to and banks bring up valid arguments to not offer cryptocurrencies to their clients as it is a high risk at the moment.

The positive side regarding cryptocurrencies is, that it is decentralized, so the market will take influence and choose the value. On the other side and compared to the current fiat system it might be an additional solution and definitely a store of value, depending on how you define -> value.